cckurugamestation.ru

Prices

Binance Instant Withdrawal

How to Withdraw from Binance to Bank Account? · 1. Log in to your account · 2. Go to the withdrawals page · 3. Select a currency and withdrawal method · 4. Verify. To be able to buy crypto instantly on the cckurugamestation.ru Bitcoin Exchange, create an account and top-up your balance. You can register either an individual or a. How Do I Deposit/Withdraw Cryptocurrency on Binance? Frequently Asked Questions on Binance App Funding Wallet Migration · Why Hasn't My Withdrawal Arrived · How. Get your account settings prepared: To make a withdrawal, you need to enable "Phone Number+Trading Password" or "Email+Google 2fa+Trading Password", all can be. Credit & debit cards. Make deposits via cards easily. · USD, EUR, AUD · 10 - 5, Min-max withdrawal. 10 - 10, Deposit processing time. Instant ; Online. These transactions are processed free of charge and are instant once processed. If your uploaded credit / debit card has already expired, please upload the. For instant card withdrawals, the withdrawal will be processed in 5 minutes. For other payment methods like SWIFT, it can take 1 to 4 business days for your. You must have withdrawn to the address through the website and approved the withdrawal via email before you can withdraw using the API. from cckurugamestation.ruions. Get an instant loan secured by crypto assets · NFT. Explore NFTs from creators Deposit Fiat. Withdraw Fiat. Orders. Community. How to Withdraw from Binance to Bank Account? · 1. Log in to your account · 2. Go to the withdrawals page · 3. Select a currency and withdrawal method · 4. Verify. To be able to buy crypto instantly on the cckurugamestation.ru Bitcoin Exchange, create an account and top-up your balance. You can register either an individual or a. How Do I Deposit/Withdraw Cryptocurrency on Binance? Frequently Asked Questions on Binance App Funding Wallet Migration · Why Hasn't My Withdrawal Arrived · How. Get your account settings prepared: To make a withdrawal, you need to enable "Phone Number+Trading Password" or "Email+Google 2fa+Trading Password", all can be. Credit & debit cards. Make deposits via cards easily. · USD, EUR, AUD · 10 - 5, Min-max withdrawal. 10 - 10, Deposit processing time. Instant ; Online. These transactions are processed free of charge and are instant once processed. If your uploaded credit / debit card has already expired, please upload the. For instant card withdrawals, the withdrawal will be processed in 5 minutes. For other payment methods like SWIFT, it can take 1 to 4 business days for your. You must have withdrawn to the address through the website and approved the withdrawal via email before you can withdraw using the API. from cckurugamestation.ruions. Get an instant loan secured by crypto assets · NFT. Explore NFTs from creators Deposit Fiat. Withdraw Fiat. Orders. Community.

Binance Australia suspended Australian Dollar (AUD) deposits using PayID with immediate effect. Workarounds to the Binance withdrawal problem. There are. Specify the withdrawal amount: Enter the amount of cryptocurrency you would like to withdraw. Be aware of minimum withdrawal amounts and any network fees that. Sign in to your Binance account · Go to Wallets · Choose Withdraw · Copy your cckurugamestation.ru wallet deposit address and paste it on Binance for withdrawal · Finish. To start using your Skrill Mastercard, you first need to transfer funds from Binance to Skrill so you will have sufficient funds to spend money. Bitcoin (BTC) withdrawals can take between 10 to 30 minutes to confirm successfully. Binance Smart Chain withdrawals are usually processed in just a few minutes. -Log into your Binance account. -Select the cryptocurrency you wish to withdraw. -Click on “Withdraw” and follow the instructions. -Provide the withdrawal. Depositing and withdrawing funds to and from your SimpleFX trading account is simple, secure, and cckurugamestation.ru can deposit via local transfers, such as FasaPay. Withdrawals- Processing Time. Withdrawals to an external address may take hours to process. Withdrawals to the cckurugamestation.ru App are instant. Withdrawals- Fiat. Withdrawals will be processed within 5 minutes for instant card withdrawals. SWIFT payment method on the other hand can take 1 to 4 business. The withdrawal of Binance BUSD might not directly affect real-time payments or instant card services offered by Deel. However, in order to receive payments. A withdrawal from the cckurugamestation.ru App is a transaction of transferring crypto from the cckurugamestation.ru environment to an external address (usually a wallet or an. However, despite this increased interest, Binance does not currently support fiat withdrawals in Kenya. This means that users in Kenya are. To withdraw to a cryptocurrency address, simply: · 1. Open your Skrill account · 2. Click 'Withdraw' and then 'Crypto Wallet' · 3. Enter the amount you want to. At PrimeXBT we process Crypto withdrawals instantly. In rare cases it may take up to 24 hours to process your withdrawal on a business day. We also offer. Already listed on binance airdrop with instant withdrawal join fast your unique referral link is: cckurugamestation.ru?start=r Connect your Binance account and get paid in cypto. All payments are transferred instantly. Book a call · Sign up now. Get paid in crypto. Best for Cashback: Binance · Fees: Up to a 2% transaction fee for transactions and ATM withdrawals · No. of Crypto Supported: 14 · Rewards: 8% cashback. Making withdrawals easy ; 10 USD, Up to 2 business days, None, Withdraw ; 10 USD, Instant, None, Withdraw. Instant deposit options. Withdrawals are processed 24/5. No transaction fees Binance Coin (BUSD). VISA. CREDIT CARD | INSTANT. Swiftly fund your. In the blog post, the exchange confirmed that clients can deposit and withdraw their Euro via Open Banking and SEPA/SEPA Instant. Having restored EUR spot.

What Exactly Is Nft

NFTs (or “non-fungible tokens”) are a special kind of cryptoasset in which each token is unique — as opposed to “fungible” assets like Bitcoin and dollar bills. 1. What is an NFT? What does NFT stand for? An NFT (Non-Fungible Token) is a unique digital asset stored on a blockchain, representing ownership or. A non-fungible token (NFT) is a unique digital identifier that is recorded on a blockchain · NFTs can be created by anybody and require few or no coding skills. What is an NFT? NFT (Non-Fungible Token) is a unique digital asset that is stored on a blockchain. NFTs can represent anything from artwork to music to. NFT stands for non-fungible token. Essentially, “non-fungible” means that the thing being traded – in this case digital art – is unique and can't be replaced. Non-fungible tokens, also known as NFTs are an application Blockchain technology that lets them be distinguished from one another. They are able to represent. Non-fungible tokens, often referred to as NFTs, are blockchain-based tokens that each represent a unique asset like a piece of art, digital content, or media. What does NFT stand for?” As stated earlier, NFT stands for non-fungible token. A digital artifact that reflects real-world assets such as art, music, in-game. NFTs, or non-fungible tokens, are cryptographic objects on the blockchain that are distinguishable from one another by unique identifiers and metadata. NFTs (or “non-fungible tokens”) are a special kind of cryptoasset in which each token is unique — as opposed to “fungible” assets like Bitcoin and dollar bills. 1. What is an NFT? What does NFT stand for? An NFT (Non-Fungible Token) is a unique digital asset stored on a blockchain, representing ownership or. A non-fungible token (NFT) is a unique digital identifier that is recorded on a blockchain · NFTs can be created by anybody and require few or no coding skills. What is an NFT? NFT (Non-Fungible Token) is a unique digital asset that is stored on a blockchain. NFTs can represent anything from artwork to music to. NFT stands for non-fungible token. Essentially, “non-fungible” means that the thing being traded – in this case digital art – is unique and can't be replaced. Non-fungible tokens, also known as NFTs are an application Blockchain technology that lets them be distinguished from one another. They are able to represent. Non-fungible tokens, often referred to as NFTs, are blockchain-based tokens that each represent a unique asset like a piece of art, digital content, or media. What does NFT stand for?” As stated earlier, NFT stands for non-fungible token. A digital artifact that reflects real-world assets such as art, music, in-game. NFTs, or non-fungible tokens, are cryptographic objects on the blockchain that are distinguishable from one another by unique identifiers and metadata.

An NFT is a unique unit of data stored on a blockchain infrastructure that cannot be copied or altered, providing a secure record of ownership (typically. NFTs: An Overview. NFT stands for Non-Fungible Token, which is a unique digital asset that represents ownership of a specific item or piece of content on a. An NFT is a digital version of those rare, one-of-a-kind collectibles that people go wild over, like traditional art or baseball cards. Non-fungible tokens (NFTs) are cryptographically unique tokens that are linked to digital (and sometimes physical) content, providing proof of ownership. NFTs, or Non-Fungible Tokens, are like digital collector's items. They represent ownership of unique items like artwork, music, or even virtual. NFT meaning: 1. abbreviation for non-fungible token: a unique unit of data (= the only one existing of its type. Learn more. What is an NFT? At its most basic level, a non-fungible token (NFT) is a digital asset stored on the Ethereum blockchain. Unlike other forms of. NFT definition: What are NFTS. The definition of NFT is as follows: An NFT is a unique cryptographic asset that leverages the blockchain for security. But. Non-fungible tokens or NFTs are unique cryptographic assets that are printed on a specific blockchain that they are related to. You have probably read this NFT. Non-fungible tokens, also known as NFTs are an application Blockchain technology that lets them be distinguished from one another. They are able to represent. NFTs are tokens based on a blockchain that represent ownership of a digital asset. The recent craze in NFTs involves digital art and creation. NFT means non-fungible token. · A non-fungible token cannot be exchanged or replaced (unlike bitcoin). · Most NFTs are stored on the Ethereum blockchain. · Digital. Think of an NFT as a digital item: music files, art, or real estate that offers proof of ownership. By owning an NFT, you gain the ability to sell the item and. What is an NFT? NFT stands for “non-fungible token” and can come in a variety of image formats. What Is an NFT (Non-Fungible Token)?. Last Updated Date: August 14, NFT Definition. DEFINITION. A non-fungible token (NFT) is a digital token that has. With NFTs, the artists become their own distribution channel. Moreover, they enjoy the full monetary benefits of their Sales. Creatives from Film and music are. What Is the Point of an NFT? NFTs represent ownership of assets that can be digital or real. Processed by blockchain networks, it is much simpler and faster. What does NFT stand for? What does NFT stand for? NFT stands for non-fungible token. In short, non-fungible means distinct and unduplicatable, while a token is. NFT art is a form of digital art and, like all other creative plug sockets, can be used for authentic artistic expression.

The Best 401 K Plan Providers

Creating an ideal combination. When you and your independent retirement plan providers team up with Schwab Retirement Business Services, you get expertise and. Learn more about Fidelity Advantage (k). Plan details · Pricing overview · Investment lineup. Or, continue learning to decide if this is the. The Best (k) Plans of August · ShareBuilder k · Merrill Edge (k) Plan · Employee Fiduciary (k) Plan · Vanguard (k) Plan · Fidelity Investments. Betterment makes it simple to manage your plan administration. This allows you to offer better (ks) to your employees quickly and easily, at a fraction of. A (k) is a tax-advantaged retirement savings plan. Named after a section of the US Internal Revenue Code, the (k) is an employer-provided, defined-. Watch this short video from a Fisher Retirement Plan Specialist to learn how to shop for the right advisor for your business's retirement plan. Companies With the Best (k) Match Plans · Activision Blizzard · Visa · Comcast · Apple · Microsoft · Accenture · Amazon · Google; Netflix; Meta. How much. k Provider Comparison Chart ; Investment Flexibility**, No, Yes, No, No ; Google review rating, 2, 3, , Fidelity offers fixed fees for the employer with their small business k plans, $ setup and $ per quarter for administration. Creating an ideal combination. When you and your independent retirement plan providers team up with Schwab Retirement Business Services, you get expertise and. Learn more about Fidelity Advantage (k). Plan details · Pricing overview · Investment lineup. Or, continue learning to decide if this is the. The Best (k) Plans of August · ShareBuilder k · Merrill Edge (k) Plan · Employee Fiduciary (k) Plan · Vanguard (k) Plan · Fidelity Investments. Betterment makes it simple to manage your plan administration. This allows you to offer better (ks) to your employees quickly and easily, at a fraction of. A (k) is a tax-advantaged retirement savings plan. Named after a section of the US Internal Revenue Code, the (k) is an employer-provided, defined-. Watch this short video from a Fisher Retirement Plan Specialist to learn how to shop for the right advisor for your business's retirement plan. Companies With the Best (k) Match Plans · Activision Blizzard · Visa · Comcast · Apple · Microsoft · Accenture · Amazon · Google; Netflix; Meta. How much. k Provider Comparison Chart ; Investment Flexibility**, No, Yes, No, No ; Google review rating, 2, 3, , Fidelity offers fixed fees for the employer with their small business k plans, $ setup and $ per quarter for administration.

RocketDollar. RocketDollar is another solo k provider that is highly recommended. If you want to compare apples-to-apples, they are slightly more expensive. Several reputable (k) plan providers cater to small businesses. The popular options are ADP, Paychex, American Funds, Charles Schwab, Employee Fiduciary, and. Today's workers highly value employer-sponsored retirement plans: 88% of them say that an employee-funded retirement plan is important to them. In addition. Combine the features of a group (k) and a profit-sharing plan so you get the best of both worlds. Expert help from real humans. We mean it when we say we're. Top 10 Small Business (k) Plan Providers · ADP · American Funds · Betterment for Business · Charles Schwab · Edward Jones · Employee Fiduciary · Fidelity. Paychex is a great solution for small businesses that want to run a (k) plan. First, they offer seamless integration with the small business retirement plan. What to look for in a good (k) plan provider · 1. Make plan setup and processing simple · 2. Help drive employee engagement · 3. Offer agility to plan sponsors. Employee Fiduciary is a bundled (k) provider. That means we are the only company you need to hire to offer a plan to your employees unless you also want a. Fidelity Advantage (k). An affordable plan for small businesses looking to offer a (k) for the first time. Learn more. Our low-cost k plans are easy to setup online and are supported by our k advisors and specialists. ShareBuilder k serves small business and medium-. Benefits Administration Made Easy With Paychex · Find the Best Retirement Plan Option for You · SECURE Act Can Help You Save · Retirement Savings Requirements. For small business owners, (k) plans and IRAs are two popular choices. A (k) plan is best suited for a business owner who wants to max out their. The solo (k) companies to consider · Best for mutual funds: Fidelity · Best for low expense ratios: Vanguard · Best for alternative investments: Rocket Dollar. 15 Companies with Awesome k Plans Hiring Now · 1. Vanguard. The Details: According to its Glassdoor profile, Vanguard offers a k plan that one employee. For the best (k) investment, we recommend a target-date fund. Target-date funds are designed to be an entire retirement portfolio in one. They adjust their. Top 10 k Companies of · 1. ForUsAll · 2. ShareBuilder (k) · 3. GO · 4. Employee Fiduciary (k) Plan · 5. SaveDay · 6. T. Rowe Price · 7. Vanguard (k). If you're self-employed or run an owner-only business, you can make substantial contributions toward your retirement with a Charles Schwab Individual (k). The Danger of a poor (k) Plan. Stock brokerage, insurance, and mutual fund companies can all offer (k) plans; but may not be the best choice for your. k Provider Comparison Chart ; Investment Flexibility**, No, Yes, No, No ; Google review rating, 2, 3, , For information on cybersecurity best practices that service providers should follow, see DOL's website. Which type of (k) plan best suits your business?

Tax Tables For 2021 Federal Taxes

Forms · Contact · Index. Tax Rates. Filing & Paying Your Taxes · Payment Options · Penalties and Interest · Extensions and Prepayment · Income Tax Estimator. Earned income — income you receive from your job(s) — is measured against seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Tax Brackets for , , and Back Taxes in Previous Tax Years. Get to Know How You Are Being Taxed by Income; Find Your Effective Tax Rate. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Tax Chart. To identify your tax, use your Missouri taxable income from Form MO, Line 27Y and 27S and the tax chart in. Section A below. A separate. Historical Tax Tables may be found within the Individual Income Tax Booklets. Note: The tax table is not exact and may cause the amounts on the return to be. Taxes. Tax Calculator · Tax Brackets · Capital Gains · Social Security. Tax Changes for - - rates have been extended for everyone. (See chart. Tax Information for Individual Income Tax. For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to. Forms · Contact · Index. Tax Rates. Filing & Paying Your Taxes · Payment Options · Penalties and Interest · Extensions and Prepayment · Income Tax Estimator. Earned income — income you receive from your job(s) — is measured against seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Tax Brackets for , , and Back Taxes in Previous Tax Years. Get to Know How You Are Being Taxed by Income; Find Your Effective Tax Rate. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Tax Chart. To identify your tax, use your Missouri taxable income from Form MO, Line 27Y and 27S and the tax chart in. Section A below. A separate. Historical Tax Tables may be found within the Individual Income Tax Booklets. Note: The tax table is not exact and may cause the amounts on the return to be. Taxes. Tax Calculator · Tax Brackets · Capital Gains · Social Security. Tax Changes for - - rates have been extended for everyone. (See chart. Tax Information for Individual Income Tax. For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to.

The legislature to levy and collect taxes on taxable, individual income at a rate not to exceed 5 percent. It further provides for minimum personal exemptions. Tax Chart. To identify your tax, use your Missouri taxable income from Form MO, Line 27Y and 27S and the tax chart in. Section A below. A separate. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. tax brackets and federal income tax rates ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, Income Tax Withholding · Use Tax · Estate Tax · Fiduciary Tax · Determine Household Vermont Tax Tables. Tax Year Vermont Rate Schedules · Income Tax Withholding · Use Tax · Estate Tax · Fiduciary Tax · Determine Household Vermont Tax Tables. Tax Year Vermont Rate Schedules · Tax Types Current Tax Rates Prior Year Rates Business Income Tax Effective July 1, Corporations – 7 percent of net income Trusts and estates – Individual Income Tax rates range from 0% to a top rate of 7% on taxable income for tax years and prior, from 0% to a top rate of % on taxable income. Rates for Tax Years ; Not over $10, 4% of the taxable income. ; Over $10, but not over $40, $, plus 6% of the excess over $10, ; Over. If your Nebraska taxable income is more than the highest amount in the tax table, see instructions at the end of the table. Over. But not over. Single Married. Taxes & Forms; Tax Rate Schedules. Tax Rate Schedules For Tax Years , , and the North Carolina individual income tax rate is % (). Tax brackets (Taxes due in ) ; Tax Rate, Single Filers/ Married Filing Separate (MFS), Married Individuals Filing Jointly/ Qualifying Surviving Spouses. Determination of Tax. The tax is determined using tax tables furnished by the Louisiana Department of Revenue. The tax rate is applied in a graduated scale. The tax table can be used if your Virginia taxable income is listed in the table. Otherwise, use the Tax Rate Schedule. $ 4, – $ 5, $ The Taxation and Revenue Department offers taxpayers the ability to file their tax return online and check the status of their refunds through the Taxpayer. Home · Individual Taxes; Tax Rates. Maryland Income Tax Rates and Brackets. The chart shown below outlining the Maryland income tax rates and brackets. A common misconception is that your marginal tax rate is the rate at which your entire income is taxed. So someone in the 35% tax bracket pays 35% in taxes. If you would like to fill out your Kentucky forms and schedules without software help or assistance, you may use KY File, the New Kentucky Filing Portal, to. To calculate the Colorado income tax, a “flat” tax rate of percent is applied to federal taxable income after adjusting for state additions and. The tax table can be used if your Virginia taxable income is listed in the table. Otherwise, use the Tax Rate Schedule. $ 4, – $ 5, $

What Is Wealth

Wealth is often synonymous with financial abundance and material possessions. Dictionaries define it as an abundance of valuable assets, riches, or property. What's the difference between wealth inequality and income inequality, and why does it matter? · Personal wealth means a · Statistics on income inequality risk. Wealth is the amassing of limited resources. In common belief, wealth can be defined as an abundance of objects bearing economic merit. Bank of America Private Bank provides comprehensive wealth management services and customized financing solutions to meet your private banking needs. Wealth measures the value of all assets of worth owned by a person, community, company, or country. Here, we discuss how to build and manage wealth. According to Schwab's Modern Wealth Survey, Americans said that it takes an average net worth of $ million to qualify a person as being wealthy, a bit. a large amount of money or valuable possessions that someone has: During a successful business career, she accumulated a great amount of wealth. Wealthfront is designed to build wealth over time. Earn % APY on your uninvested cash, invest in a ladder of US Treasuries, and diversify for the long. Wealth Wealth refers to the total assets minus liabilities owned by a household. It plays a crucial role in social and economic stratification, impacting. Wealth is often synonymous with financial abundance and material possessions. Dictionaries define it as an abundance of valuable assets, riches, or property. What's the difference between wealth inequality and income inequality, and why does it matter? · Personal wealth means a · Statistics on income inequality risk. Wealth is the amassing of limited resources. In common belief, wealth can be defined as an abundance of objects bearing economic merit. Bank of America Private Bank provides comprehensive wealth management services and customized financing solutions to meet your private banking needs. Wealth measures the value of all assets of worth owned by a person, community, company, or country. Here, we discuss how to build and manage wealth. According to Schwab's Modern Wealth Survey, Americans said that it takes an average net worth of $ million to qualify a person as being wealthy, a bit. a large amount of money or valuable possessions that someone has: During a successful business career, she accumulated a great amount of wealth. Wealthfront is designed to build wealth over time. Earn % APY on your uninvested cash, invest in a ladder of US Treasuries, and diversify for the long. Wealth Wealth refers to the total assets minus liabilities owned by a household. It plays a crucial role in social and economic stratification, impacting.

Wealth. Millennials have a far different view of it than their boomer parents. While young adults generally do not have much accumulated wealth. Being wealthy is typically perceived as having an abundance of money. However, that is only 1 type of wealth – Financial Wealth. We'll work with you on wealth-building strategies that focus on what's important to you, your needs and your plans for your family or business. In The Origin of Wealth, Eric D. Beinhocker argues that modern science provides a radical perspective on these age-old questions, with far-reaching implications. Wealth definition: a great quantity or store of money, valuable possessions, property, or other riches. See examples of WEALTH used in a sentence. a large amount of money or valuable possessions that someone has: During a successful business career, she accumulated a great amount of wealth. A wealth planner will take a holistic approach to understand your lifestyle, your goals, your family dynamics and your priorities. The word wealth has many shades of meaning, but most involve having a lot of something — often money or something else that's valuable. Wealth refers to intangible and tangible things that make people, households, groups, towns, or even whole nations better off, ie richer. The distribution of wealth is a comparison of the wealth of various members or groups in a society. It shows one aspect of economic inequality or economic. According to the Federal Reserve, white households held percent of all U.S. wealth as of the fourth quarter of , while making up only 77 percent of. wealth Wealth is the possession of a large amount of money, property, or other valuable things. You can also refer to a particular person's money or property. The definition of wealth is personal. It means something different to everyone. What it means to be wealthy is entirely up to you and you can get there. Wealth 63 Craig L. Blomberg See also Money; Reward; Wages; Work Bibliography. J. Ellul, Money and Power; GA Getz, A Biblical Theology of Material Possessions. Wealth Tax. A wealth tax is imposed on an individual's net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be. Wealth, as I've said, refers to the value of everything people own, minus what they owe, but the focus is on "marketable assets" for purposes of economic and. The most comprehensive and up-to-date resource of its kind. Our Global wealth report analyzes the household wealth of billion people across the globe. Wealth management is the process of putting together a bespoke financial plan that is specifically designed to help you reach those goals. Comprehensive wealth accounting can provide an estimate of the total wealth of nations by measuring the value of different components of wealth. Changes in. A wealth planner will ask a lot of questions to find out who you really are and what matters to you, and base their bespoke advice on what they discover.

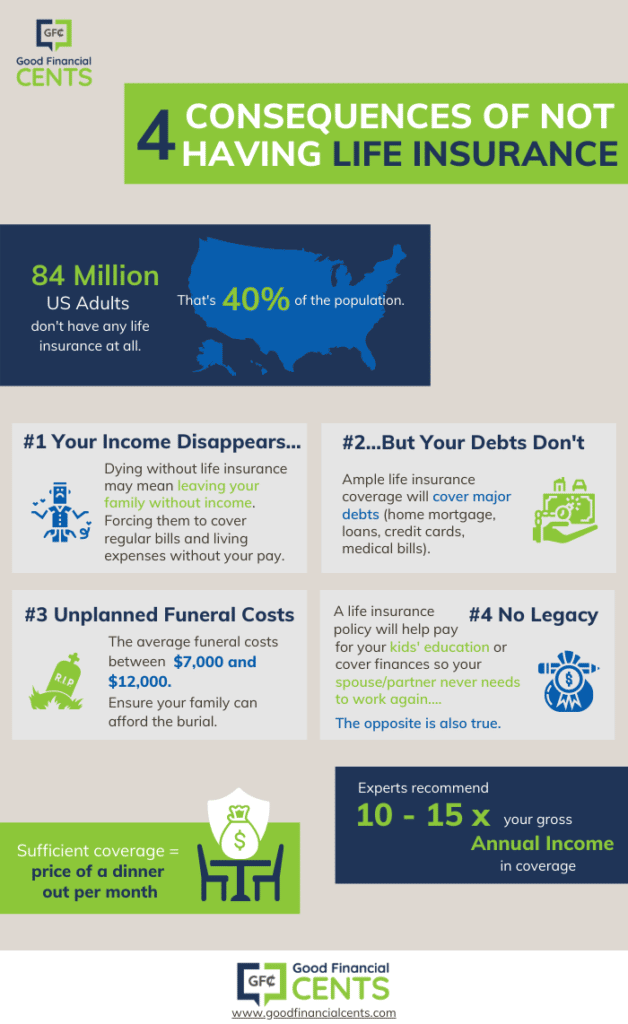

Not Having Life Insurance

Term life insurance is intended to provide lower-cost coverage for a specific period and generally have lower premiums in the early years, but do not build up a. If the policyholder stopped paying their premiums, the insurance policy may lapse. In this situation, the insurer can cancel the policy and not pay the death. You may not need life insurance if you have substantial savings for end-of-life expenses or your loved ones can easily support themselves without your income. If no primary or contingent beneficiaries can be found, the death benefit will be paid to your estate. As part of naming beneficiaries, you should identify them. Term insurance has no buildup of cash value as some other types of insurance allow. (There are some term life insurance policies that offer a return of premium;. OVERVIEW. Life insurers understand the frustrations people feel when they believe a life insurance policy exists but do not have a record of it. After they retire in years you should no longer need life insurance. You should have retirement savings and zero mortgage. No-exam life insurance can issue a policy to you without needing a medical exam, drastically reducing what can sometimes be a lengthy ordeal. If you pass away during that time, a death benefit is paid to your beneficiaries – but when the term is over, you have to get new coverage or go without. Term life insurance is intended to provide lower-cost coverage for a specific period and generally have lower premiums in the early years, but do not build up a. If the policyholder stopped paying their premiums, the insurance policy may lapse. In this situation, the insurer can cancel the policy and not pay the death. You may not need life insurance if you have substantial savings for end-of-life expenses or your loved ones can easily support themselves without your income. If no primary or contingent beneficiaries can be found, the death benefit will be paid to your estate. As part of naming beneficiaries, you should identify them. Term insurance has no buildup of cash value as some other types of insurance allow. (There are some term life insurance policies that offer a return of premium;. OVERVIEW. Life insurers understand the frustrations people feel when they believe a life insurance policy exists but do not have a record of it. After they retire in years you should no longer need life insurance. You should have retirement savings and zero mortgage. No-exam life insurance can issue a policy to you without needing a medical exam, drastically reducing what can sometimes be a lengthy ordeal. If you pass away during that time, a death benefit is paid to your beneficiaries – but when the term is over, you have to get new coverage or go without.

The biggest consequence of not having life insurance is the financial hardships that your family will face when you are gone. Getting a life insurance policy The most important thing to remember is not to let your circumstances prevent you from applying for life insurance coverage. What happens if you miss your life insurance payment depends on the type of life insurance you have: Investment and insurance products are not federally. If a life insurance policy has no living beneficiaries or no beneficiaries were named, the death benefit is usually paid to the policy owner's estate. In this. At the Guardian Life Insurance Company of America, we believe that having coverage is beneficial, but we also recognize that not everyone needs life insurance. Simplified issue life insurance requires no lab work or medical exam. Eligibility for this type of coverage is based on answers to basic health questions. If. Single person with no dependents: Funeral expenses; medical bills; debts, such as credit cards or student loans; elderly parents who may be dependent upon you. Chances are you may not have enough life insurance coverage for yourself or your loved ones. Life events, such as getting married, having children and. No. Include Historical Content. - Any -, No. Search. Help Menu Mobile. Help. Menu Generally, life insurance proceeds you receive as a beneficiary due to the. When you die, your beneficiaries will receive a lump-sum payment that is guaranteed to be paid in full (provided all premiums are paid and there are no. When it comes to millennials, 55% have no life insurance coverage at all, and 45% don't believe they have enough life insurance, or think they would not qualify. Life insurance with no medical exam can get you coverage quickly. Learn how it works and the types of no medical exam life insurance policies available. Once your term policy expires, the policy is no longer in force. That means you don't have existing coverage, so your loved ones won't receive a death benefit. If you're single with no children, life insurance may not be a priority. But if you have a family or are planning on starting one soon, or if you have debt. As a rule, term policies offer a death benefit with no savings element or cash value. Premiums are locked in for the specified period of time under the policy. buy cover years ago may no longer apply. Children, mortgages, and a lack of long-term financial security are some of the main reasons people buy life insurance. Life insurance is a resource if: For example, burial insurance and most kinds of term insurance have no cash surrender value. These are not resources. No matter what the reason, here are some steps to take if you're denied life insurance. Contact your financial professional and/or the insurer. They can make. What is no-medical-exam life insurance? Medical exams are used in underwriting, the process used by insurance companies to decide how much to charge you in.

What Is Nix

NIX definition: 1. to stop, prevent, or refuse to accept something: 2. nothing or no: 3. to stop, prevent, or. Learn more. Nix The Vector nixpkg is supported and maintained by the open source community. Nix is a cross-platform package manager implemented on a functional deployment. transitive verb US, informal: to refuse to accept or allow (something): veto, reject The court nixed the merger. Nix, in Germanic mythology, a water being, half human, half fish, that lives in a beautiful underwater palace and mingles with humans by assuming a variety. Nix is a cross-platform package manager for Unix-like systems, and a tool to instantiate and manage Unix-like operating systems, invented in by Eelco. Nix comes with the powerful, functional Nix (programming) language to manage packages of many ecosystems at once; not just Javascript or Java like Node and. Nix is an ecosystem of tools that provide a declarative, reproducible, isolated approach to building, installing, and configuring software. After creating your Nix environment "Nix file," you can use it in your Slurm script because your program depends on the packages contained in the environment. The meaning of NIX is to refuse to accept or allow (something): veto, reject. How to use nix in a sentence. NIX definition: 1. to stop, prevent, or refuse to accept something: 2. nothing or no: 3. to stop, prevent, or. Learn more. Nix The Vector nixpkg is supported and maintained by the open source community. Nix is a cross-platform package manager implemented on a functional deployment. transitive verb US, informal: to refuse to accept or allow (something): veto, reject The court nixed the merger. Nix, in Germanic mythology, a water being, half human, half fish, that lives in a beautiful underwater palace and mingles with humans by assuming a variety. Nix is a cross-platform package manager for Unix-like systems, and a tool to instantiate and manage Unix-like operating systems, invented in by Eelco. Nix comes with the powerful, functional Nix (programming) language to manage packages of many ecosystems at once; not just Javascript or Java like Node and. Nix is an ecosystem of tools that provide a declarative, reproducible, isolated approach to building, installing, and configuring software. After creating your Nix environment "Nix file," you can use it in your Slurm script because your program depends on the packages contained in the environment. The meaning of NIX is to refuse to accept or allow (something): veto, reject. How to use nix in a sentence.

NIX definition: 1. to stop, prevent, or refuse to accept something: 2. nothing or no: 3. to stop, prevent, or. Learn more. A build tool, package manager, and programming language. Concepts / Nix We recommend starting with the Nix quick start and consulting concept docs. Bazel is a multi-language build system with support for incremental and remote builds. Nix usually encompasses many things. A package manager, a build system. Nix is a tool that takes a unique approach to package management and system configuration. Learn how to make reproducible, declarative and reliable systems. Nix is a powerful package manager for Linux and other Unix systems that makes package management reliable and reproducible. Please refer to the Nix manual. Nix is a powerful package manager for Linux and other Unix systems that makes package management reliable and reproducible. Please refer to the Nix manual. Repository files navigation Nixpkgs is a collection of over , software packages that can be installed with the Nix package manager. It also implements. The language you use to define Nix package builds, development environments, NixOS configurations, and more. NixOS is a Linux-based operating system which is built on top of the Nix package manager. It is customizable and focuses on building reliable system images. Overview of the Nix Language The Nix language is designed for conveniently creating and composing derivations – precise descriptions of how contents of. NixOS is a free and open source Linux distribution based on the Nix package manager. NixOS uses an immutable design and an atomic update model. The Nix language is designed for conveniently creating and composing derivations – precise descriptions of how contents of existing files are used to derive new. Nix offers an imperative package management command line tool - nix-env - which can be used to install packages at the user level. Packages installed using nix-. zshrc file that it writes (another symlink to the Nix store), Files in the Nix store are read-only so any configuration files 'owned' by home-manager (~/.zshrc. Nix is a package manager which focuses on caputuring all inputs which contribute to building software. cckurugamestation.ru is the home of official documentation for the Nix ecosystem. It is maintained by the Nix documentation team. If you're new here, install Nix and begin. Nix® is the #1 pharmacist recommended brand for head lice treatment. Nix® Lice medicines kill lice and their eggs (nits). rix is an R package that leverages Nix, a powerful package manager focusing on reproducible builds. With Nix, it is possible to create project-specific. A build tool, package manager, and programming language. Concepts / Nix We recommend starting with the Nix quick start and consulting concept docs. Getting Started with Nix¶ · Install packages into the system through user profiles. · Manipulate and select channels. · Search for packages. Nix vs traditional.

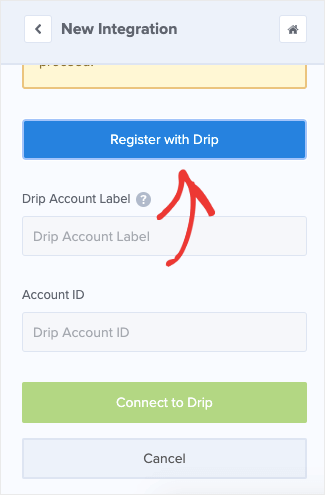

How To Open A Drip Account

Users just select 'DRIP' when setting up their account to enroll. Don't forget about how DRIPs fit into your overall investment strategy and diversification. How to enrol To enrol, simply submit the required DRIP form to your dealer back office before the ETF's distribution record date. Once enrolled, distributions. How to Set Up Your DRIP · Download the DRIP Application Form: Fill out your account number on the top right. · Select Your Securities: Choose either "All eligible. DRIP/DSPP · Buy shares by direct debit to your bank account or by check. · Invest amounts as low as $25 per month. · Apply cash dividends toward the purchase of. Login to the Stash website. · Click your name in the upper-right corner. · Click Dividend reinvestment program. · Click the slider next to Automatically reinvest. DRIPs are dividend reinvestment plans that allow investors to receive additional shares in the place of cash dividends. To enroll in DRIP, you need to call your. How to set up a DRIP. Learn about the Dividend Reinvestment Plan (DRIP), and how setting one up can help you save on commissions. The DRIP administrator will purchase shares directly from us or in the open market. Each time we make a dividend or other distribution, we will decide how the. Finally, investors must first buy shares in the company, in order to set up a DRIP account. To qualify for this program, DRIP operating companies often require. Users just select 'DRIP' when setting up their account to enroll. Don't forget about how DRIPs fit into your overall investment strategy and diversification. How to enrol To enrol, simply submit the required DRIP form to your dealer back office before the ETF's distribution record date. Once enrolled, distributions. How to Set Up Your DRIP · Download the DRIP Application Form: Fill out your account number on the top right. · Select Your Securities: Choose either "All eligible. DRIP/DSPP · Buy shares by direct debit to your bank account or by check. · Invest amounts as low as $25 per month. · Apply cash dividends toward the purchase of. Login to the Stash website. · Click your name in the upper-right corner. · Click Dividend reinvestment program. · Click the slider next to Automatically reinvest. DRIPs are dividend reinvestment plans that allow investors to receive additional shares in the place of cash dividends. To enroll in DRIP, you need to call your. How to set up a DRIP. Learn about the Dividend Reinvestment Plan (DRIP), and how setting one up can help you save on commissions. The DRIP administrator will purchase shares directly from us or in the open market. Each time we make a dividend or other distribution, we will decide how the. Finally, investors must first buy shares in the company, in order to set up a DRIP account. To qualify for this program, DRIP operating companies often require.

NNN REIT offers a dividend reinvestment and direct stock purchase plan designed to make purchasing our stock economical and convenient. The plan is open to. To set up a DRIP, you need at least one trade-settled, DRIP eligible security in your account. If you set up a DRIP for your entire account, any new eligible. Dividend Reinvestment Plans (DRIP) and Direct Stock Purchase Plans Online detailed account access. Purchasing Additional Shares. Shareholders may. How do I invest in PIMCO Funds? · What are the differences in share classes? · What is the minimum needed to open a mutual fund account? · How do I exchange shares. To set up a DRIP in your TD Direct Investing account, contact an Investment Representative at or () Ready to start investing. Enterprise announced its Distribution Reinvestment Plan ("DRIP") in July (Open Market Purchase) 05/12/ Distribution, -, $, -, -. (Open Market. The dividend reinvestment plan (DRIP) is a free program that allows cash dividends you receive to automatically be used to purchase additional whole or. COMPUTERSHARE REGISTRATION Existing Users of Computershare ; ACCESS YOUR COMPUTERSHARE ACCOUNT Contacting Computershare by Phone (Toll Free). Once you are a shareholder of record, contact the company for a DRIP application and prospectus. The prospectus provides all the details about the program. Select Account → Settings → Investing · Select Dividend reinvestment · Toggle the switch On · If prompted, complete the onboarding process. DRIP, but brokers may provide a DRIP on some investments to investors. With a broker-operated DRIP, brokers purchase shares on the open market. Typically. Select Account → Settings → Investing · Select Dividend reinvestment · Toggle the switch On · If prompted, complete the onboarding process. DIVIDEND REINVESTMENT PROGRAM. Page 2. The Zions Bancorporation Dividend Reinvestment Plan (“the Plan”) is the most simple and economical way to purchase. Apex individual accounts, IRAs, or advisor accounts are not eligible for DRIP. Can I apply DRIP to any security? Only securities available for fractional shares. DRIP investing allows you to accumulate shares for compounding returns without having to place an order or worry about commissions. Access the Dividend. This link will open a new browser window for EQ Shareholder Services where you can open an account and purchase shares online and reinvest your dividends. The Kimco Realty Corporation Dividend Reinvestment and Direct Stock Purchase Plan ("DRIP open market. Please access the following link for further information. First, your account must have a fully-settled DRIP eligible security to enroll. Equity stock and ETF opening trades take 1 business day to settle. DRIP. If I own shares of Johnson & Johnson that are held by my broker, can I participate in the DRIP program? Shares held by a broker are registered to the broker.

Best Surgery For Weight Loss

LHMC options for surgical weight loss include: laparoscopic gastric bypass, sleeve gastretomy, adjustable gastric band or Roux-en-Y gastric bypass. Gastric Balloon. One of the most common endoscopic weight loss procedures is the gastric balloon. This treatment places a silicone balloon in the stomach to. Of the three most common procedures, gastric bypass produced greater weight loss, on average, but had more complications in the month after surgery. Most people. Laparoscopic gastric banding (LAGB) is a minimally intrusive weight loss surgical treatment. LAGB surgery is characterised by small abdominal incisions rather. Body Mass Index (BMI) greater than 40 or BMI greater than 35 with medical complications related to obesity, including high blood pressure, type 2 diabetes. It works very well for weight loss, and you can lose up to pounds. It's one of the better procedures to improve or resolve diabetes. It is also a very good. Bariatric surgery can help people lose weight and live healthy, active lives. There are several types of bariatric surgery procedures, but all work by changing. The main types of weight loss surgery are gastric bypass, gastric band, gastric balloon and sleeve gastrectomy. To be considered for NHS weight loss surgery you. For people with obesity who have struggled with less invasive weight-loss options, bariatric surgery is an effective and safe weight-loss treatment that helps. LHMC options for surgical weight loss include: laparoscopic gastric bypass, sleeve gastretomy, adjustable gastric band or Roux-en-Y gastric bypass. Gastric Balloon. One of the most common endoscopic weight loss procedures is the gastric balloon. This treatment places a silicone balloon in the stomach to. Of the three most common procedures, gastric bypass produced greater weight loss, on average, but had more complications in the month after surgery. Most people. Laparoscopic gastric banding (LAGB) is a minimally intrusive weight loss surgical treatment. LAGB surgery is characterised by small abdominal incisions rather. Body Mass Index (BMI) greater than 40 or BMI greater than 35 with medical complications related to obesity, including high blood pressure, type 2 diabetes. It works very well for weight loss, and you can lose up to pounds. It's one of the better procedures to improve or resolve diabetes. It is also a very good. Bariatric surgery can help people lose weight and live healthy, active lives. There are several types of bariatric surgery procedures, but all work by changing. The main types of weight loss surgery are gastric bypass, gastric band, gastric balloon and sleeve gastrectomy. To be considered for NHS weight loss surgery you. For people with obesity who have struggled with less invasive weight-loss options, bariatric surgery is an effective and safe weight-loss treatment that helps.

Of all the different types of weight loss surgeries, patients lose the most weight on average and maintain their weight loss after gastric bypass. What are the. The Surgical Weight Loss Institute at Good Samaritan Hospital offers a unique team approach to weight loss. Our program offers personal intensive pre-operative. For context, gastric sleeve surgery is still the most popular operation, but sometimes a sleeve isn't working, or there's a good reason to do something else. Most patients with previous bands or stomach stapling procedures are likely to be better off with gastric bypass as a revisional procedure. The gastric sleeve, a newer surgery, has become the most popular weight loss procedure today. With this surgery, we remove about 80% of your stomach. A long. surgery can be an effective way to lose weight and maintain that weight loss procedure is best for you. When considering weight-loss surgery, you. North Texas Surgical Specialists in Fort Worth, Texas offer 2 bariatric surgery procedures for weight loss: gastric bypass and gastric sleeve. Bariatric surgery is sometimes called weight loss surgery. More precisely, it is metabolic surgery. Through this procedure, experts in this field can address. Gastric Bypass vs. Gastric Sleeve: Which Surgery Is Better? · Gastric bypass patients lose between 50 to 80 percent of excess bodyweight within 12 to 18 months. Our Team · Bariatric Surgeons · Donald T Hess, MD · Brian J. Carmine, MD · Joshua D Davies, MD · Luise I. Pernar, MD, MHPE · Advanced Practice Provider · Bridget. LHMC options for surgical weight loss include: laparoscopic gastric bypass, sleeve gastretomy, adjustable gastric band or Roux-en-Y gastric bypass. The primary goal of bariatric surgery is to treat obesity. For many severely overweight men and women, weight loss surgery is often the best and safest option. da Vinci® robotic-assisted surgery offers the most advanced form of minimally invasive bariatric surgery. Personalized care. We find the best surgical or non-. Benefits of minimally invasive weight loss surgery include: Faster healing. Less pain. Lower risk of infection. Minimal scarring. This popular procedure is. Weight-loss surgery, also called metabolic and bariatric surgery The type of weight-loss surgery that may be best for you depends on a number of factors. We understand how difficult weight loss can be. Even with the best of efforts, managing your weight can involve frustrating ups and downs, and can even feel. North Texas Surgical Specialists in Fort Worth, Texas offer 2 bariatric surgery procedures for weight loss: gastric bypass and gastric sleeve. Bariatric surgery (or metabolic surgery or weight loss surgery) is a medical term for surgical procedures used to manage obesity and obesity-related conditions. Weight loss surgery is also known as bariatric and metabolic surgery. These terms are used in order to reflect the impact of these operations on patients'. There are three basic approaches to weight loss surgery: restrictive, malabsorptive and combined restrictive and malabsorptive.

How To Move Money From 401k To Roth Ira

Roth IRA. Traditional. IRA. SIMPLE IRA. SEP-IRA. Governmental. (b). Qualified plans include, for example, profit-sharing, (k), money purchase, and. Pre-tax only: You can only transfer pre-tax IRA funds to a (k). Under current law, you cannot transfer Roth IRA assets into a Roth (k) or Roth b. If you have pre-tax money in the (k) plan that you roll into a Roth IRA, that would be considered a Roth conversion, which is a taxable event. Submit a NYCE IRA Incoming Rollover Form. If the assets are from the City's Roth (k) Plan, they can be rolled over after severance from City service (or. An IRA rollover (also known as IRA transfer) is a way to take your previous (k) retirement account with you, but there are tax impacts to be aware of. Keep. The establishment date of the Roth (k) does not carry over to the Roth IRA. If before rolling over you wait until your Roth (k) is qualified, the entire. So to answer your first question, yes, it could make sense to open a Roth IRA at least five years before you plan to rollover your Roth (k). Can I roll my (k) into a Roth IRA without penalty? You can roll over (k) to a Roth IRA without penalty as long as you follow the day rule if you're. If you have a traditional (k) or (b), you can roll over your money into a Roth IRA. However, this would be considered a "Roth conversion," so you. Roth IRA. Traditional. IRA. SIMPLE IRA. SEP-IRA. Governmental. (b). Qualified plans include, for example, profit-sharing, (k), money purchase, and. Pre-tax only: You can only transfer pre-tax IRA funds to a (k). Under current law, you cannot transfer Roth IRA assets into a Roth (k) or Roth b. If you have pre-tax money in the (k) plan that you roll into a Roth IRA, that would be considered a Roth conversion, which is a taxable event. Submit a NYCE IRA Incoming Rollover Form. If the assets are from the City's Roth (k) Plan, they can be rolled over after severance from City service (or. An IRA rollover (also known as IRA transfer) is a way to take your previous (k) retirement account with you, but there are tax impacts to be aware of. Keep. The establishment date of the Roth (k) does not carry over to the Roth IRA. If before rolling over you wait until your Roth (k) is qualified, the entire. So to answer your first question, yes, it could make sense to open a Roth IRA at least five years before you plan to rollover your Roth (k). Can I roll my (k) into a Roth IRA without penalty? You can roll over (k) to a Roth IRA without penalty as long as you follow the day rule if you're. If you have a traditional (k) or (b), you can roll over your money into a Roth IRA. However, this would be considered a "Roth conversion," so you.

Roll over old ks or IRAs to T. Rowe Price to simplify your retirement savings. We'll work with your current provider to handle most of the paperwork. If you decide to roll over your TSP assets to an IRA, you can choose either a traditional IRA or Roth IRA. No taxes are due if you roll over assets from a. A transfer is a non-reportable movement of funds between 2 retirement accounts of the same type, such as transferring money from one traditional IRA into. Your Choices: · Roll over to a traditional IRA · Roll over to a Roth IRA · Take a lump-sum distributionFootnote · Leave the assets in your former plan · Move to a. Generally, you'll only be able to transfer a (k) to a Roth IRA if you are rolling over your (k), the plan allows in-service withdrawals, or the plan. Whereas a Roth IRA is funded by your after-tax money, allowing for tax-free disbursements. If you convert your traditional (k) balance to a Roth IRA, you. However, numerous (k) plans allow employees to transfer funds to an IRA while they are still with their employer. If your IRA is set up as a Roth IRA. If you own a traditional IRA or other non-Roth IRA, or have an old workplace retirement plan such as a (k), (b), or (b), you can pay taxes on your. An IRA rollover1 is the process of transferring funds from an employer-sponsored retirement plan, often a (k) or (b), into an IRA retirement account. After-tax funds can be segregated from other funds in the account and transferred directly to a Roth IRA. In fact, it would be a mistake not to. How to move your old (k) into a rollover IRA · Step 1: Set up your new account · Step 2: Contact your old (k) provider · Step 3: Deposit your money into your. The first is to roll the Roth (k) funds into an existing Roth IRA. The rollover funds will be counted toward the clock that's been ticking since the opening. One of the main reasons why people consider a Roth IRA conversion is to take advantage of the future tax benefits provided by a Roth IRA, but it is important to. A rollover IRA is an account that allows you to move funds from an old employer-sponsored plan, like a (k), to an IRA (k) to a Traditional IRA or Roth. Step 1 – Choose an IRAExpand · Step 2 — Transfer funds from your old QRPExpand · Step 3 — Invest your savingsExpand. A rollover is when you move money from an employer-sponsored plan, such as a (k) or (b) account, into an employer-sponsored plan held at Vanguard or a. If you've worked at several jobs, you may have a few k-type plans from previous employers plus your own IRA accounts. Managing all those accounts can be. You can also convert pre-tax (a) contributions into Roth contributions and then roll the funds over into a Roth IRA, although you'll be liable for taxes on. High earners who can't contribute to a Roth IRA or deduct traditional IRA contributions can potentially convert traditional IRA or (k) funds into a Roth IRA. You may also choose to consolidate all your traditional IRAs into one traditional IRA, or all your Roth IRAs into one Roth IRA, if eligible. This move can help.